NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

The alcohol delivery market has been abuzz with activity. DoorDash (NYSE: DASH) recently launched an alcohol delivery option in select states, while Uber (NYSE: UBER) finalized its acquisition of Drizly. An analysis of transaction data reveals that even though bars and restaurants have gradually reopened during the pandemic, sales at same-day alcohol delivery companies like Drizly, Saucey, and Minibar exceed pre-pandemic levels.

Furthermore, Drizly shoppers have positive affinity toward other Uber-owned brands. Cross-shopping behavior also shows that Drizly customers who shop at Uber Eats spend more on average each month at both companies than customers who shop exclusively at either company.

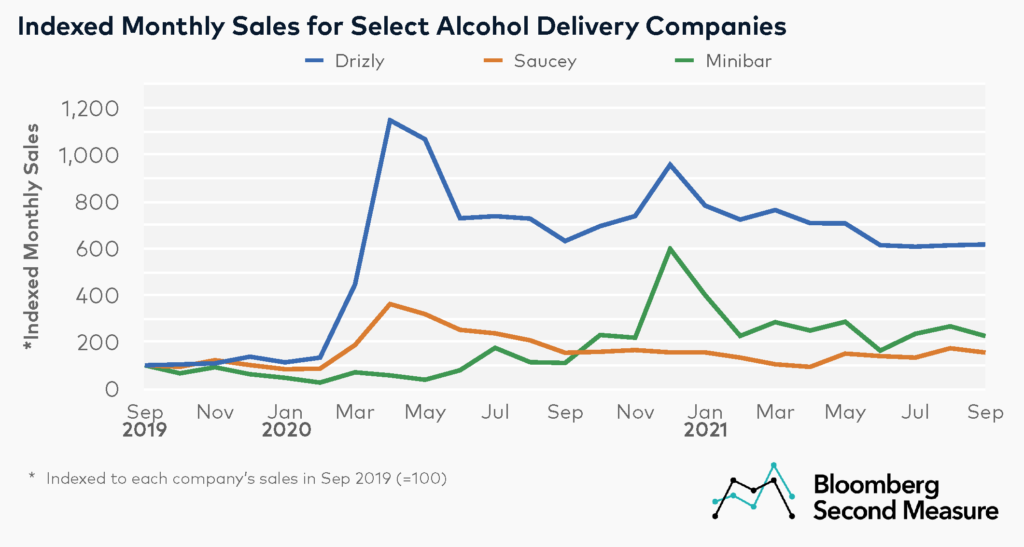

Alcohol delivery sales still exceed pre-pandemic levels

When many bars and restaurants temporarily shut their doors at the onset of shelter-in-place orders, sales skyrocketed for alcohol delivery companies and wine subscription companies. Between February and March of 2020, sales at Drizly grew 235 percent. Minibar sales grew 167 percent month-over-month in the same time period, while Saucey sales grew 118 percent.

Sales for these alcohol delivery services have remained elevated since the initial surge. In September 2021, Drizly sales were 517 percent higher than they were two years ago, while Minibar sales were 125 percent higher and Saucey sales were 55 percent higher. Over the last 24 months, sales at Drizly and Saucey peaked in April 2020, while sales at Minibar were highest in December 2020. Notably, Drizly and Minibar both offer gift delivery, and the holiday season may account for the spike in sales that each company experienced in December 2020.

Although sales at all three companies still surpass pre-pandemic levels, sales growth has slowed in 2021 for Drizly and Saucey, while Minibar sales have continued to grow significantly year-over-year. In September 2021, Minibar sales were 105 percent higher year-over-year, while year-over-year sales growth at Drizly and Saucey were -2 percent and 1 percent, respectively.

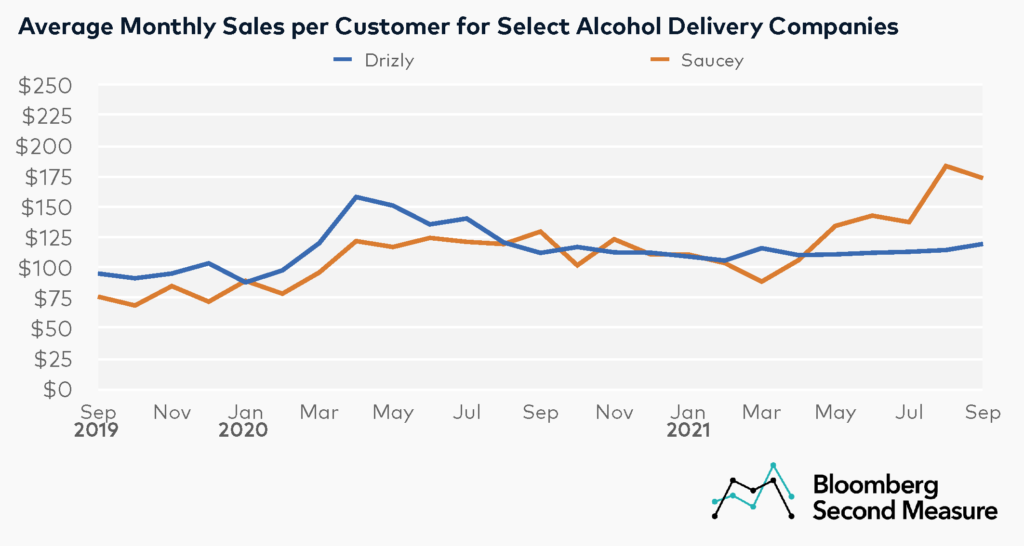

Sales per customer at Saucey has more than doubled over the past two years

Both Saucey and Drlzly experienced a substantial jump in monthly sales per customer in April 2020, with respective month-over-month increases of 27 percent and 32 percent. Monthly sales per customer at Saucey have continued to grow since then, whereas monthly sales per customer at Drizly remain elevated but have leveled off. As of September 2021, the average monthly sales per customer was $173 at Saucey and $119 at Drizly.

The average monthly sales per customer at Saucey in September 2021 represented an increase of 34 percent year-over-year and a 128 percent increase from two years ago. Drizly’s average monthly sales per customer in September 2021 was 7 percent higher than in September 2020 and 26 percent higher than in September 2019.

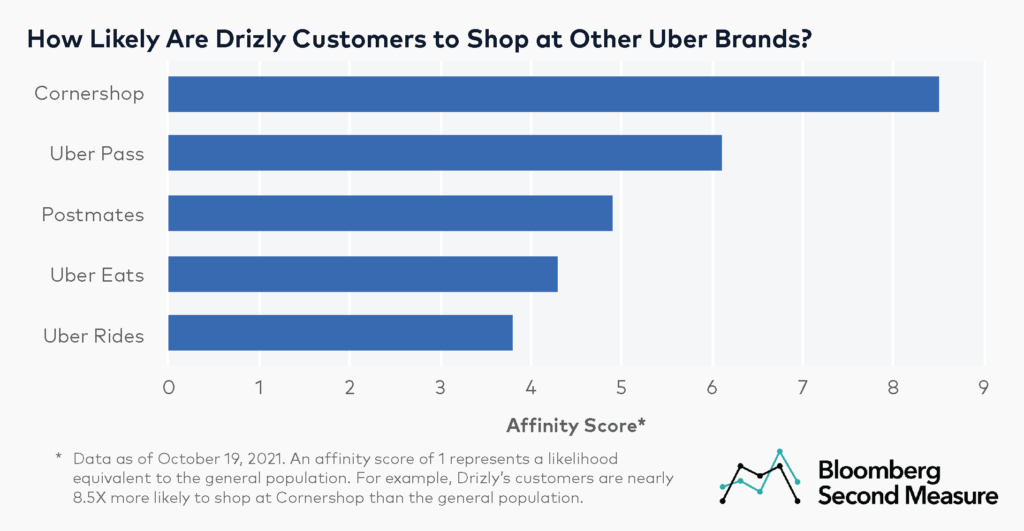

Drizly customers are more likely to shop at Uber-owned brands compared to the general population

In February 2021, Uber announced that it was planning to acquire Drizly. The acquisition was completed in October 2021. According to Uber, Drizly’s marketplace will be featured within the Uber Eats app, in addition to maintaining its own app and website. Uber Eats also offers its own alcohol delivery service, as well as delivery from restaurants, convenience stores, and grocery stores.

Company affinity data, which shows where else customers of a given company are more likely to spend compared to the general population, reveals that Drizly’s shoppers have positive affinity toward other Uber-owned brands. When it comes to Uber’s biggest brands–Uber Rides and Uber Eats–Drizly shoppers are roughly 4 times more likely than the general population to use each.

Drizly customers also have a higher likelihood than the general population to shop at other companies that Uber has acquired. For example, Drizly customers are 8.5 times more likely than the general population to buy from Cornershop, a grocery delivery company that was acquired by Uber over the summer. Drizly customers are also about 5 times more likely than the general population to use food delivery platform Postmates.

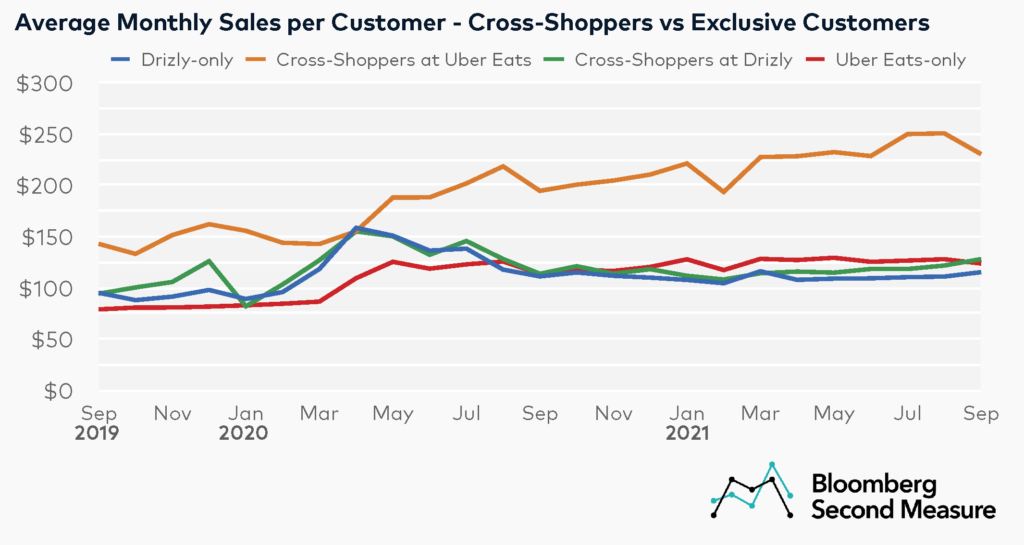

How does consumer spending among cross-shoppers compare to that of exclusive customers?

An analysis of cross-shopping over the past two years reveals that Drizly customers who also shop at Uber Eats spend more on average each month at both companies than company-exclusive customers.

In September 2021, cross-shopping customers spent an average of $230 at Uber Eats, compared to $124 for customers who only shopped at Uber Eats. Likewise, cross-shopping customers spent an average of $128 at Drizly in September 2021, compared to $115 for Drizly-exclusive customers.

*Note: Bloomberg Second Measure regularly refreshes its panel and methods in order to provide the highest quality data that is broadly representative of U.S. consumers. As a result, we may restate historical data, including our blog content.